Zhitong Finance learned that on Thursday, the three major indexes rose and fell, and investors waited for Friday’s non-farm payrolls report. The European Central Bank announced its June interest rate decision, and as expected, it cut interest rates by 25 basis points, the first time since 2019. Yesterday, the Bank of Canada announced a 25 basis point interest rate cut.

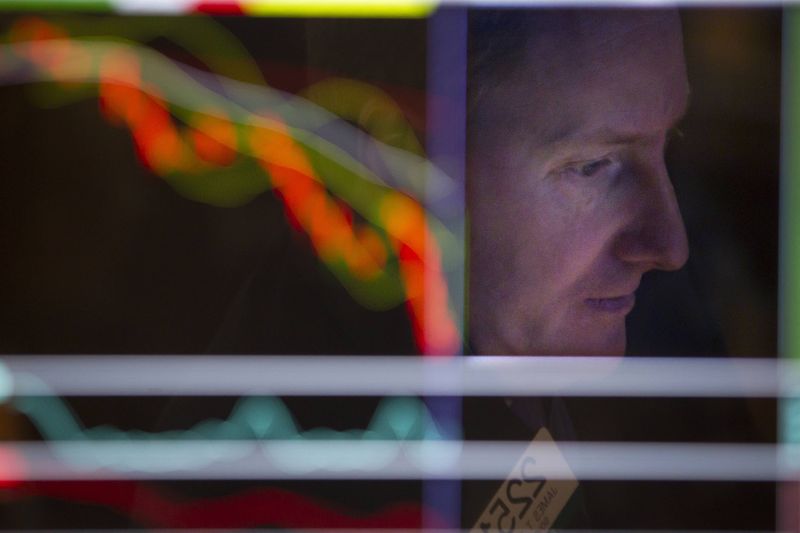

[US stocks] As of the close, the Dow Jones Industrial Average rose 78.84 points, or 0.20%, to 38,886.17 points; the Nasdaq fell 14.78 points, or 0.09%, to 17,173.12 points; the S&P 500 fell 1.07 points, or 0.02%, to 5,352.96 points. Nvidia (NVDA.US) fell 1%, with fierce long and short trading, and a daily turnover of US$78.6 billion. GameStop (GME.US) closed up more than 47%, and the leader spoke again. The Nasdaq China Golden Dragon Index fell 0.14%.

[European stocks] Major European stock indices rose, with the Euro Stoxx 50 up 0.66%, the German DAX30 up 0.41%, the British FTSE 100 up 0.47%, and the French CAC40 up 0.42%.

[Asia-Pacific stock markets] The Nikkei 225 rose 0.55%, the Singapore Straits Times Index rose slightly, the Vietnamese VN30 rose 0.2%, and the Singapore Straits Times Index rose 0.02%.

[Cryptocurrency] Bitcoin fell 0.54% to $70,738.4 per coin; Ethereum fell more than 1.7% to $3,799.15 per coin.

[Gold] COMEX gold futures rose 0.83% to $2,395.1 per ounce; COMEX silver futures rose 4.6% to $31.455.

[Metals] London metals rose, with London copper up more than 2%, London zinc up nearly 2%, London nickel up more than 1.8%, and London aluminum up more than 1%.

[Macro news]

The number of people applying for unemployment benefits in the United States increased last week. The number of Americans filing for unemployment benefits increased last week, but underlying strength in the job market should continue to support the economy. The Labor Department said on Thursday that initial claims for unemployment benefits rose by 8,000 to a seasonally adjusted 229,000 in the week ended June 1, above market expectations of 220,000. Data earlier this week showed that U.S. job openings fell more than expected in April, with the number of available jobs per job seeker reaching its lowest level since June 2021. At the same time, however, Challenger data showed that U.S. employers announced the fewest layoffs since December last year last month, and the number of layoffs announced so far in 2024 was also lower than last year.

The U.S. trade deficit widened in April. The U.S. trade deficit widened in April as an increase in imports outweighed a slight increase in exports. The U.S. Commerce Department’s Bureau of Economic Analysis said on Thursday that the trade deficit increased 8.7% to $74.6 billion. March data was revised slightly narrower to $68.6 billion. Imports rose 2.4% to $338.2 billion in April. Goods imports increased $8.1 billion to $271.9 billion. Imports of capital goods such as automobiles and parts, computer accessories and telecommunications equipment, as well as industrial supplies and raw materials including crude oil, all increased. Exports rose slightly by 0.8% to $263.6 billion. Goods exports increased by $2.2 billion to $172.7 billion. Capital and consumer goods exports increased, while industrial supplies and materials exports fell. Service exports fell by $200 million to $172.7 billion.

The Federal Reserve will release the results of its annual bank stress test on June 27. The Federal Reserve will release the results of its annual bank stress test at 4:30 p.m. on June 26 (4:30 a.m. Beijing time the next day), covering 32 banks with assets of $100 billion or more. The Fed said in its statement on Thursday that the hypothetical scenarios include a severe global recession and pressure on commercial and residential real estate markets. The Fed will also include the “overall results” of the first exploratory analysis, but this part will not affect bank capital requirements. Stress testing is a tool to measure whether banks have enough capital to absorb losses and thus lend to households and businesses during severe recessions.

Morgan Stanley Wealth Management CIO: U.S. stocks will rise further in the second half of the year. Lisa Shalett, CIO of Morgan Stanley Wealth Management, said that the U.S. stock market will continue its upward trend in the second half of 2024, although the pace will slow down. “The path of least resistance between now and the end of the year is for the market to go higher.” Shalett added that despite this, investors should have “modest expectations” for stock returns between now and December, with the S&P 500 index up 12% so far this year. Despite Shalett’s optimism, she said that this year’s corporate profit expansion is already reflected in stock prices, and as 2024 continues to move forward, investors will need to start “borrowing” expectations for 2025. On the bright side, she expects gains to extend to all sectors of the market, not just the mega-cap tech giants that have driven most of the gains since last year.

Several European Central Bank hawks expressed regret for making a commitment to cut interest rates too early.

[Individual Stock News]

The U.S. Boeing (BA.US) “Starliner” spacecraft docked with the International Space Station. The U.S. Boeing “Starliner” spacecraft carrying two American astronauts arrived at the International Space Station on the 6th and docked with it. This is the first manned test flight of the “Starliner”. According to NASA, the two astronauts will stay in the space station for about 8 days to test the “Starliner” and its subsystems. The “Starliner” also carried about 345 kilograms of cargo, including food and necessities. After the mission is completed, NASA will conduct final certification for the “Starliner” to carry out regular commercial manned space missions and regularly transport astronauts to and from the space station.

NIO (NIO.US) revealed the progress of the third brand Firefly and strive to start delivery in the first half of next year. On June 6, at NIO’s first quarter 2024 earnings call, NIO management revealed the latest progress of the company’s third brand Firefly. According to NIO management, the research and development of Firefly is progressing very smoothly and performing very well. It is positioned as a boutique small car in China, with a price of more than 100,000 yuan, but it is itself established according to very high safety and quality standards. At present, it is planned to share a sales network with NIO, similar to BMW and MINI, and strive to start delivery in the first half of next year, but the release time has not yet been determined.

Lyft (LYFT.US) expects a 15% compound annual growth rate in total bookings over the next three years. Lyft, a US ride-sharing service company, said at the start of its first investor day on Thursday that it expects a 15% compound annual growth rate in total bookings over the next three years. The company also expects its adjusted EBIT margin to be 4% by 2027, compared with analysts’ expectations of 3.4%.

[Ratings of major banks]

Barclays: Lowered Lululemon Athletica’s (LULU.US) target price from $395 to $338, maintaining a “neutral” rating

Bank of America: Give Apple (AAPL.US) a “buy” rating with a target price of $230