Here are five things you need to know about the financial markets on Thursday, June 6:

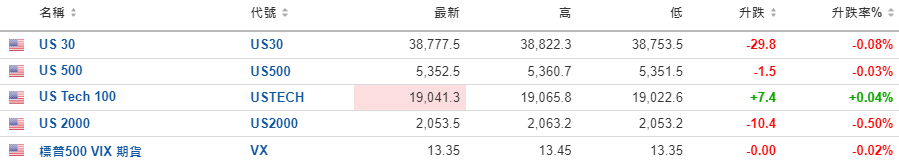

1. U.S. stock index futures consolidate sideways

U.S. stock index futures consolidated near the flat line on Thursday after the S&P 500 and the tech-heavy Nasdaq Composite both closed at record highs.

On Wednesday, the S&P 500 rose 1.18% to 5,354.03 points; the Nasdaq Composite rose 1.95% to 17,186.38 points; and the Dow Jones Industrial Average also rose, up 0.3% to 38,807.33 points.

Supporting the rise in the stock market is the 10-year U.S. Treasury yield, which fell to a two-month low, which was supported by the private employment data that was lower than expected. Previously, job vacancies in April also fell to the lowest level in more than three years, and recent employment data have all pointed to a weakening U.S. job market.

Easing labor demand may help ease upward pressure on inflation, boosting market hopes that the Federal Reserve will significantly cut interest rates from a high of more than 20 years later this year.

2. Nvidia’s market value surpasses Apple to become the world’s second most valuable company

On Wednesday, artificial intelligence chip design company NVIDIA (NASDAQ: NVDA) broke through the $3 trillion mark, surpassing Apple (NASDAQ: AAPL), becoming the world’s second most valuable company.

Nvidia has been the main beneficiary of the boom in artificial intelligence applications. For much of last year, demand for Nvidia’s artificial intelligence chips soared as more companies spent heavily to integrate AI into their operations.

Earlier this week, Nvidia unexpectedly released a roadmap for its new “Robin” AI chip, just months after the release of its previous AI chip. Despite fierce competition from rivals such as AMD (NASDAQ:AMD) and Intel (NASDAQ:INTC) as well as large cloud computing companies such as Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL) that are developing their own processors, Nvidia said it still aims to release new products “on an annual basis.”

Nvidia also reported strong earnings in May, with revenue soaring 262%. In addition, the company announced a 10-for-1 stock split on June 7.

On the other hand, Apple is scheduled to hold its much-anticipated developer conference next week, where it is expected to reveal more details about its artificial intelligence plans. Compared with many other large technology companies, Apple has not made many moves in the field of AI, but CEO Tim Cook said in a recent earnings call that AI represents a “critical opportunity.”

3. Lululemon’s stock price soared

Lululemon Athletica (NASDAQ:LULU), a high-end sportswear retailer, released its first-quarter earnings report, with profits and sales exceeding expectations, and its stock price rose more than 7% in pre-market trading.

The company’s quarterly earnings per share were $2.54, higher than Wall Street’s expectations of $2.38; net revenue was $2.21 billion, also higher than the expected $2.19 billion. The company also raised its annual earnings per share forecast and reiterated its full-year net revenue forecast.

Same-store sales in mainland China increased 33% from the same period last year, offsetting the impact of flat revenue in the Americas. Reuters quoted analysts as saying that Lululemon has been expanding its business in China, taking advantage of relatively mild domestic competition and offsetting the impact of sluggish demand from US consumers squeezed by inflation.

4. The ECB’s interest rate decision is coming, and the rate cut is finally here!

The ECB will announce the results of its interest rate meeting later, and the market generally believes that the bank will cut interest rates.

Thanks to the eurozone inflation rate falling back to the 2% target set by the ECB, ECB officials have revealed that they will cut interest rates before the meeting.

ECB President Lagarde said in May that she believed price pressures were “under control”, especially as the impact of the energy crisis and supply chain restrictions gradually faded.

Philip Lane, chief economist of the ECB, also said in an interview that unless there are major surprises, European officials believe that “removing the highest level of restrictions” is enough based on the latest information.

Investors expect the ECB to cut its benchmark deposit rate, which is currently at an all-time high of 4%, by 0.25 percentage points. But policymakers remain uncertain about how to deal with possible future rate cuts later this year. ING analysts said in a report that they “suspect the ECB will not reveal much on this issue.”

5. Crude oil prices rose slightly, but the weekly trend may still be downward

Driven by overall optimism, crude oil prices rose slightly on Thursday, but overall this week may still fall sharply.

Both U.S. crude and Brent crude fell by about 4% this week, mainly due to OPEC+’s decision to gradually lift voluntary production cuts starting in October.

In addition, data from the U.S. Energy Information Administration (EIA) showed that U.S. crude oil inventories increased by 1.2 million barrels in the week ending May 31, higher than the expected decrease of 2.3 million barrels, which also hit the crude oil market.