Investing.com - Before the market opened on Thursday (6th), U.S. stock index futures remained stagnant as the market awaited the non-farm payrolls report to be released tomorrow.

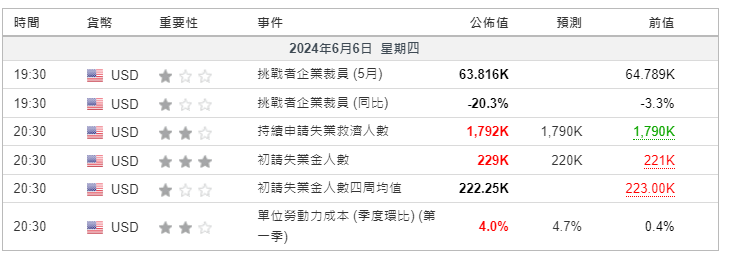

Jobless claims data released earlier came in slightly stronger than expected, adding to confidence that the labor market is slowing, while weaker employment is expected to help moderate inflation, supporting the Federal Reserve's interest rate cuts, following earlier rate cuts by the Bank of Canada and the European Central Bank.

Pre-market stocks

NVIDIA (NASDAQ:NVDA) continued to rise 1.5%. Its market value exceeded $3 trillion in the previous trading day, surpassing iPhone maker Apple to become the world's second largest company by market value.

Lululemon Athletica (NASDAQ:LULU) rose 8.8%. Its first-quarter profit and sales exceeded expectations. It also raised its annual guidance target, thanks to strong growth in the Chinese market.

Discount retailer Five Below (NASDAQ:FIVE) plunged 16% due to weak quarterly results, lowered its full-year sales forecast, and weakened demand for its once-hot plush toy Squishmallows.

Victoria's Secret (NYSE:VSCO) fell 2.9%, with a net loss of $4 million in the first quarter, and a cautious attitude towards the North American retail environment.

Used car retailer Carvana (NYSE:CVNA) rose 3.2%. Evercore ISI issued a bullish report, predicting that the company's first-quarter results may exceed analysts' expectations, citing the continued expansion of the used car industry.

Home goods retailer Big Lots (NYSE:BIG) plunged 18% after its first-quarter loss was larger than expected as consumers cut back on big-ticket items.

Microsoft (NASDAQ:MSFT) fell 0.18% as the Federal Trade Commission investigated whether Microsoft intentionally avoided antitrust scrutiny in its deal with artificial intelligence startup Inflection.

Apple (NASDAQ:AAPL) was flat. Apple's developer conference will be held next week, and it is reported that it will announce a series of product upgrade plans related to artificial intelligence.

TSMC (NYSE:TSM) continued to rise 1.6%, and is expected to set a new high. Morgan Stanley issued a report stating that there are reports that TSMC is considering raising production costs for Nvidia. The bank asked Nvidia for its opinion on TSMC's desire to increase wafer prices. Nvidia CEO Huang Renxun pointed out that TSMC's service prices are too low, and TSMC's contribution to the world and the technology industry is not fully reflected in its financial report.

Novavax (NASDAQ:NVAX) rose 16.6% after a U.S. Food and Drug Administration advisory panel voted on Wednesday to recommend an updated Covid-19 vaccine for the JN.1 variant that dominated earlier this year.

Hertz Global (NASDAQ:HTZ) rose 1% after appointing a former Spirit Airlines executive as the company's interim CFO.

Tesla (NASDAQ:TSLA) fell 0.25%. Amazon (NASDAQ:AMZN) fell 0.07%, Google's parent company Alphabet (NASDAQ:GOOG) fell 0.06%, and Facebook's parent company Meta Platforms (NASDAQ:META) fell 0.46%.

Chinese stocks

KraneShares CSI China Internet (NYSE:KWEB), a Chinese Internet ETF, fell 0.17%.

NIO (NYSE:NIO)(HK:9866) fell 4.5%, with first-quarter results missing expectations due to increased competition, but optimistic expectations for this quarter's results.

Li Auto (NASDAQ:LI)(HK:2015) fell 0.5%, and Xpeng Motors (NYSE:XPEV)(HK:9868) fell 1.2%.

NetEase (NASDAQ:NTES)(HK:9999) rose 1.15%. The Chinese mainland server of World of Warcraft: Wrath of the Lich King is expected to be launched this month.

Bilibili (NASDAQ:BILI)(HK:9626) fell 0.9%, iQiyi (NASDAQ:IQ) fell 0.2%, and Huya (NYSE:HUYA) fell 1%.

Alibaba (NYSE:BABA)(HK:9988) fell 0.5%, JD.com (NASDAQ:JD)(HK:9618) fell 1.4%, and Pinduoduo (NASDAQ:PDD) fell 0.1%.

Baidu (NASDAQ:BIDU)(HK:9888) fell 0.15%.

Other markets

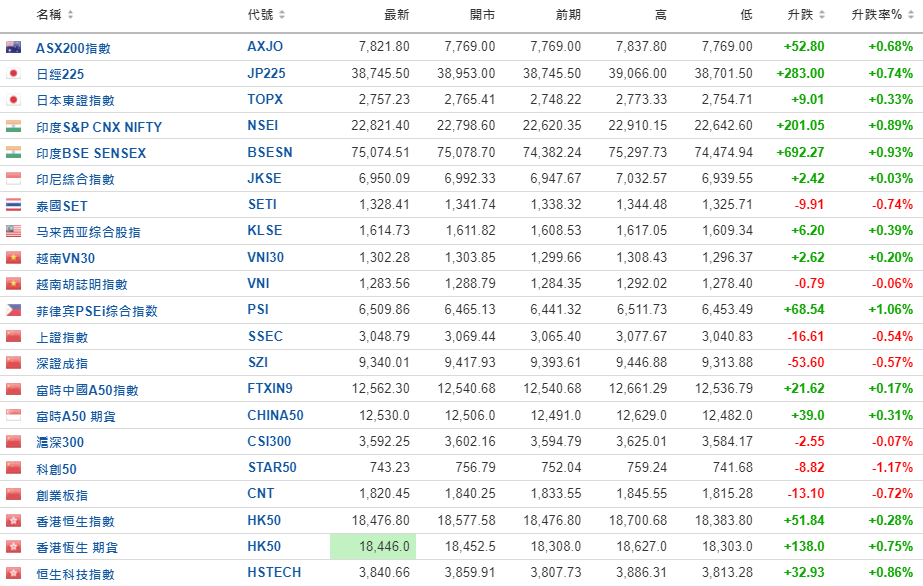

European stock markets rose collectively.

Most Asia-Pacific stock markets rose.

The US dollar index futures and the US dollar index were basically flat.

The Comex gold futures price and the spot gold price of the New York Mercantile Exchange were basically flat.

The London Brent crude oil and the US WTI crude oil futures prices rose slightly.